An outlook on U.S. jobs and retail sales

AN OUTLOOK on U.S. JOBS AND RETAIL SALES

Adam Pukalo |

The S&P 500 is down 14.0% since President Trump took office on Jan 20, 2025. His erratic approach to tariffs has shaken investor confidence, pushing markets into a sharp correction. As of now, this would be the worst first 100 days out of all new term Presidents going back to 1900, according to Carson Research.

Despite the market turbulence, hard economic data in the US shows consumer spending remains positive, with some evidence that households are accelerating big-ticket purchases ahead of potential tariff hikes. Motor vehicle and parts sales rose 8.8% year-over-year, suggesting consumers may be front-loading spending. However, the 4.8% year-over-year increase in sales at food services and drinking establishments indicates that strength in consumption isn’t limited to tariff-sensitive categories.

The labor market also remains relatively resilient. Initial jobless claims continue to hover at low levels suggesting that widespread layoffs haven’t materialized. However, the elevated level of continuing claims since the start of the year points to increased difficulty for the unemployed in finding new work.

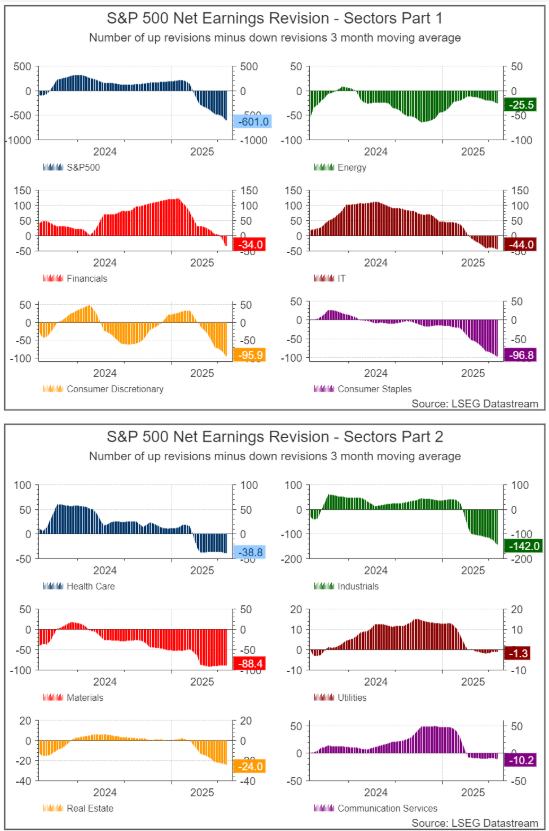

Looking at analyst revisions, all 11 sectors are seeing negative analyst earnings revisions. While there are early signs that downgrades in materials and health care may have stabilized, the outlook for financials remains weak. As of the week of April 17, 2025, negative revisions in financials have gained momentum—even though 17 of the 19 S&P 500 financial companies reporting so far beat earnings expectations, and 12 exceeded revenue estimates in Q1. Despite these strong headline results, 47 firms in the financials sector saw their average earnings targets revised down this week.

While headline results this earnings season have often beaten analyst estimates, outlook from many firms reflects growing caution. Below are what some of the banks have said during their earnings calls:

“I think probably a recession is a likely outcome,” and “When you see a 2,000-point decline in the Dow, it sort of feeds on itself... it makes you feel like you’re losing money in your 401(k), you’re losing money in your pension. You’ve got to cut back,” – JP Morgan Chase CEO Jamie Dimon.

“Client concerns over trade policy and recent market turmoil have grown. Still, our research team at this point doesn’t believe we'll see a recession, and our clients continue to show encouraging signs,” – Bank of America CFO Alistair Borthwick.

"continued volatility and uncertainty" and is "prepared for a slower economic environment in 2025," – Wells Fargo CEO Charlie Scharf.

Disclaimers

Ventum Financial Corp. is a member or participating organization of the Canadian Investor Protection Fund (CIPF), Canadian Investment Regulatory Organization (CIRO), TSX, TSX-V, and Bourse de Montreal. Information contained herein represent the views of the writer, and not those of Ventum Financial Corp. or Ventum Financial (US) Corp. (collectively “Ventum Financial”), based on assumptions which the writer believes to be reasonable. The material contained herein is for information purposes only and is not to be construed as an offer or solicitation for the sale or purchase of securities. While the information herein cannot be guaranteed, it was obtained from sources the writer believes to be reliable, but in providing it neither the writer nor Ventum Financial assume any liability. This information is given as of the date appearing on this report, and the writer and Ventum Financial assume no obligation to update the information or advise on further developments relating to securities, products or services. This report is intended for distribution in those jurisdictions where Ventum Financial is registered as an advisor or a dealer in securities. Any distribution or dissemination of this report in any other jurisdiction is strictly prohibited.